Tax extension tensions

School boards face decision deadlines as legislators mull calling a special election

Published: March 1, 2011

As time grows short to schedule a special election on tax extensions before the 2011–12 state budget year begins, school boards around California are forced to adopt “doomsday” budgets that would lay off thousands of teachers, counselors and other employees.

Local boards are making the hard decisions, but at press time lawmakers and Gov. Jerry Brown had little progress to show on Brown’s call for the special election. If voters agree to extend a state sales tax and surcharges on personal income taxes and vehicle license fees, along with extending a reduction in the state income tax’s dependent exemption credit, some $8.8 billion annually would bolster the state general fund through the 2016–17 fiscal year. With those revenues, K–12 funding will limp along close to existing levels in 2011–12 after losing $18 billion over the past three years.

Without the tax extensions?

“This is our doomsday budget of what might happen,” the Los Angeles Times quoted Los Angeles Unified School District board member Tamar Galatzan saying as the board reluctantly cut $408 million from the 2011–12 budget of the state’s largest school district. “We don’t want to do any of the things on there, but … our parents need to know what could happen if we don’t get more funding. ... Our employees need to know that, too.”

LAUSD isn’t alone. “Schools craft budgets in the dark—and prepare for deep cuts,” proclaimed one recent headline from elsewhere in the state. Others bannered fears of “major budget cuts” and “hundreds of layoff notices,” and said “schools face two budget options—bad, worse.”

That last refers to the scenarios that could play out if a) the special election proceeds and succeeds, or b) either the state Legislature fails to give voters a choice to extend the taxes or voters, given the opportunity, reject the extensions. With the extensions, for example, LAUSD could restore nearly 45 percent of that $408 million cut, according to the Times—still painful, but more manageable.

While legislators continue their penchant for ignoring budget deadlines—in this case, the time needed to crank up the special election machinery in California’s 58 counties before the new fiscal year begins—school boards throughout the state are coming up against two immutable time limits: the March 15 deadline to notify certificated employees that they may be laid off in the next fiscal year, and the deadline to file Second Interim Financial Reports on their ability to meet their financial obligations for the current fiscal year and two years beyond.

Given that, many school districts and county offices of education have heeded CSBA Assistant Executive Director for Governmental Relations Rick Pratt’s counsel at January’s Forecast Webcast: “Have a backup plan” for 2011–12, adopting budget scenarios with and without the revenue that a successful special election on the tax extensions would provide, Pratt advised.

In a letter responding to questions from Senate Budget Committee Chair Mark Leno, D-San Francisco, Legislative Analyst Mac Taylor laid out what’s at stake in the special election for schools and other public services.

“The result of removing the governor’s tax proposals is an approximately $2 billion decline in the Proposition 98 minimum guarantee for 2011–12. Balancing the budget with the constraints you have given us, however, would require even larger reductions in K–14 funding,” the head of the nonpartisan Legislative Analyst’s Office wrote to Leno Feb. 10. “As such, our list of alternatives includes a total of $4.8 billion in Proposition 98 reductions—$2 billion due to the assumed rejection of the governor’s tax proposals, plus an additional $2.8 billion to help bring the budget into balance.”

Easy links:

|

This chart compares Proposition 98’s minimum funding guarantee to actual funding levels in recent years. California last met its full obligation in the 2005–06 school year. CSBA Assistant Executive Director for Governmental Relations Rick Pratt used this chart to illustrate the impact if temporary taxes that are set to expire June 30 are not extended as Gov. Jerry Brown proposes in a special election in June. With those revenues, school funding will remain relatively flat in 2011–12; without them, the dotted line shows actual funding declining further. |

|

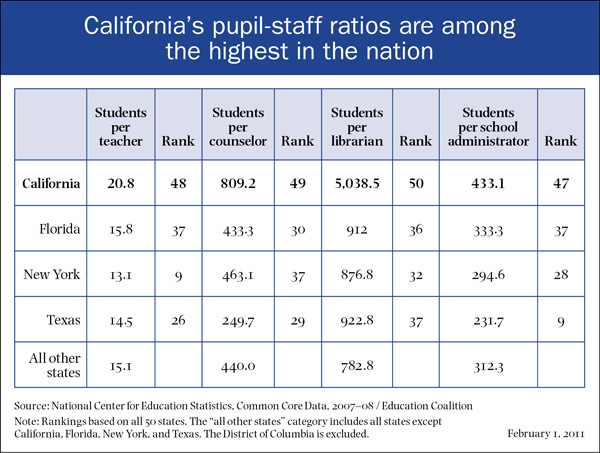

This chart from the Education Coalition’s Feb. 1 press packet shows that California ranked close to the bottom among the 50 states in a number of crucial ratios of students to staff in 2007–08—before the full brunt of three years of budget cuts to California’s schools took effect. |